Global beverage conglomerate Diageo Plc is evaluating the sale of its 65% stake in East African Breweries Limited (EABL), a move that could fetch up to KSh 258 billion (US$2 billion) and marks a significant step in the company’s broader exit from Africa’s asset-heavy markets. According to Kenyan Wall Street, the strategic review was initiated in line with Diageo’s new global direction, which favors leaner operations and reduced exposure in volatile economies.

ALSO READ: B2B vs. B2C: Understanding the Business Models That Drive Commerce

The potential sale comes as Diageo rolls out a global cost-cutting plan aimed at saving US$500 million by 2028, with a focus on offloading operational assets while retaining brand licensing rights. As reported by People Daily in May 2025, the company has already withdrawn direct operations in countries like Ghana, Ethiopia, Cameroon, and Nigeria, opting instead to work through local partners or distributors.

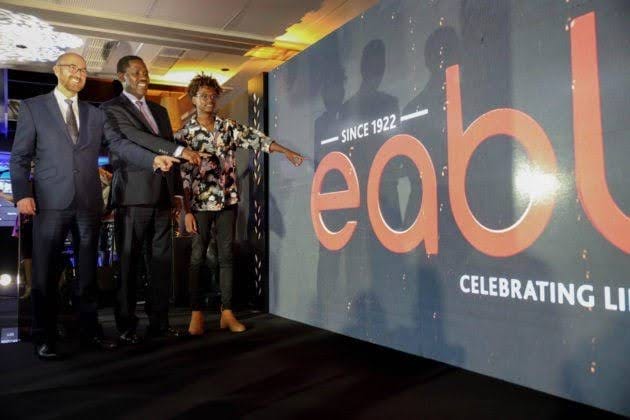

EABL is one of Diageo’s most profitable ventures in Africa, contributing nearly 65% of the firm’s continental revenue, according to analysis shared by Food Business MEA. The company’s brewing and distribution operations in Kenya, Uganda, and Tanzania, anchored by flagship brands like Tusker, Bell Lager, and Guinness have long made it a cornerstone of Diageo’s African portfolio.

Despite Diageo’s silence on the specifics of the sale, investment analysts have placed EABL’s market valuation between KSh 300–360 billion, with Standard Investment Bank suggesting in its July 2025 note that the stake could be an attractive acquisition for multinational players such as Castel Group, Heineken, or AB InBev. According to Kenya Newsline, the company may also consider retaining a minority interest post-sale to preserve brand continuity and regional leverage.

ALSO READ: Conflict Resolution in Business: A Vital Tool for Sustainable Growth

The matter has also drawn political attention. In 2023, Diageo raised its ownership in EABL by an additional 15%, spending KSh 22.7 billion through a public tender offer. According to Nation Africa, Kenyan lawmakers have since questioned the motivations behind that acquisition, alleging it was a prelude to divestiture and potential transfer to a foreign conglomerate. In response, EABL Managing Director Jane Karuku dismissed the claims as speculative, affirming that no official exit plan had been announced.

If executed, the sale would have significant implications for Kenya’s economy. EABL is a key taxpayer, employer, and one of the most traded stocks on the Nairobi Securities Exchange (NSE). As noted by Business Daily, a change in ownership structure could impact market confidence, tax revenue stability, and operational continuity, particularly if restructuring follows.

Industry experts view Diageo’s strategy as part of a growing trend among multinational consumer brands that are reassessing their African presence amid currency volatility, rising inflation, and shifting regulatory landscapes. While Africa still offers long-term growth potential, the pace of returns has slowed, pushing firms to prioritise capital-efficient models over on-the-ground infrastructure.

Any sale would require regulatory approval from both the Capital Markets Authority (CMA) and the Competition Authority of Kenya (CAK). Local economic observers believe any incoming buyer would be expected to commit to localisation, employment preservation, and continued listing of EABL on the NSE.