African founders and boardroom members are rethinking their legacies. Once keen on liquidity events and exits, increasingly African high-net-worth individuals are now prioritizing legacy as the central theme of their business plan.

This shift is not accidental. The continent’s wealthiest families are watching global dynasties like the Rothschilds and Rockefellers not just for their opulence but for the continuity of influence across generations. Africa’s emerging tycoons are asking a simple but profound question: What happens after I’m gone?

Even as family businesses in Africa have grown, succession planning remains an immature practice. A PwC Africa study in 2023 revealed that less than 30% of African family businesses have a written succession plan. For most founders, the emotional pain of relinquishing control often counteracts the logic of long-term strategy. This inattention is costly. Business dynasties that last decades fall apart within a generation due to internal conflict, lack of preparedness, or just plain resistance to change. In a continent where 80% of all jobs are created by small and medium-sized enterprises (SMEs), the health of such companies has macroeconomic implications.

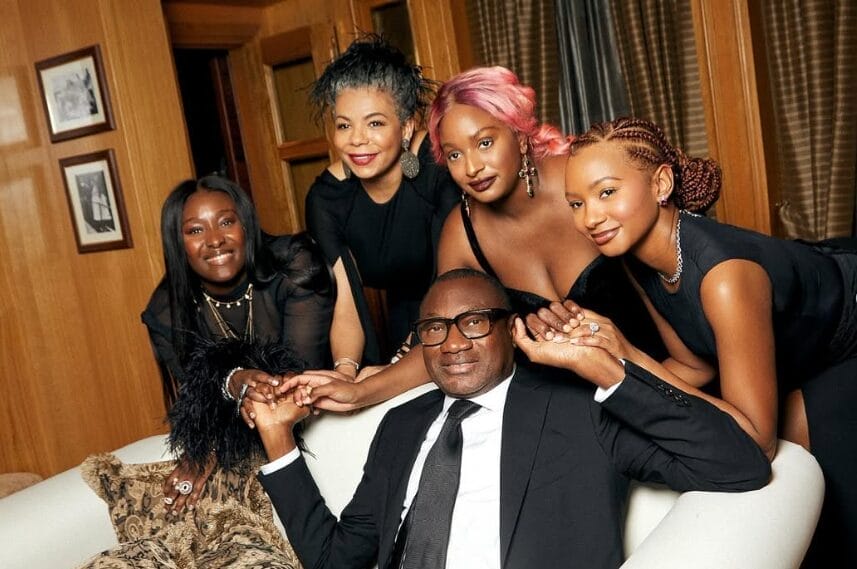

But there is a sea change. A new crop of Ivy League-educated heirs with bilingual fluency in international finance and native sensibility is coming of age. They are inheriting not just money, but responsibility. Temi Otedola is one of many heirs who is redrawing her position not so much as a celebrity icon but as a strategic investment thinker over several family assets.

We are also witnessing the development of Family Business Councils on the continent, private advisory institutions helping high-net-worth families to craft governance structures, conflict resolution processes, and investment strategies that stand the test of time.

Legacy has nothing to do with business succession; it’s about impact. The high-net-worth Africans today are investing in impact funds, Afrocentric education, cultural centers, and sustainable enterprises that bear their name beyond the boardroom. In so doing, sustaining luxury in Africa today is about sustaining relevance.

Business Insight:

Begin succession planning at 50.

Designate a legal and financial advisory board that is not family.

Introduce next-gen members to strategy planning sessions at an early stage.

Put down on paper not merely your wealth, but your values.

Final words

The next decade will move the destiny of those who do not only make money but build structures where that money and the principles it was built upon will precede them.

For further insights into how Africa’s elite are making legacies last through legacies, follow Empire Africa Magazine for weekly stories, exclusive data, and insider analysis of African business and wealth.