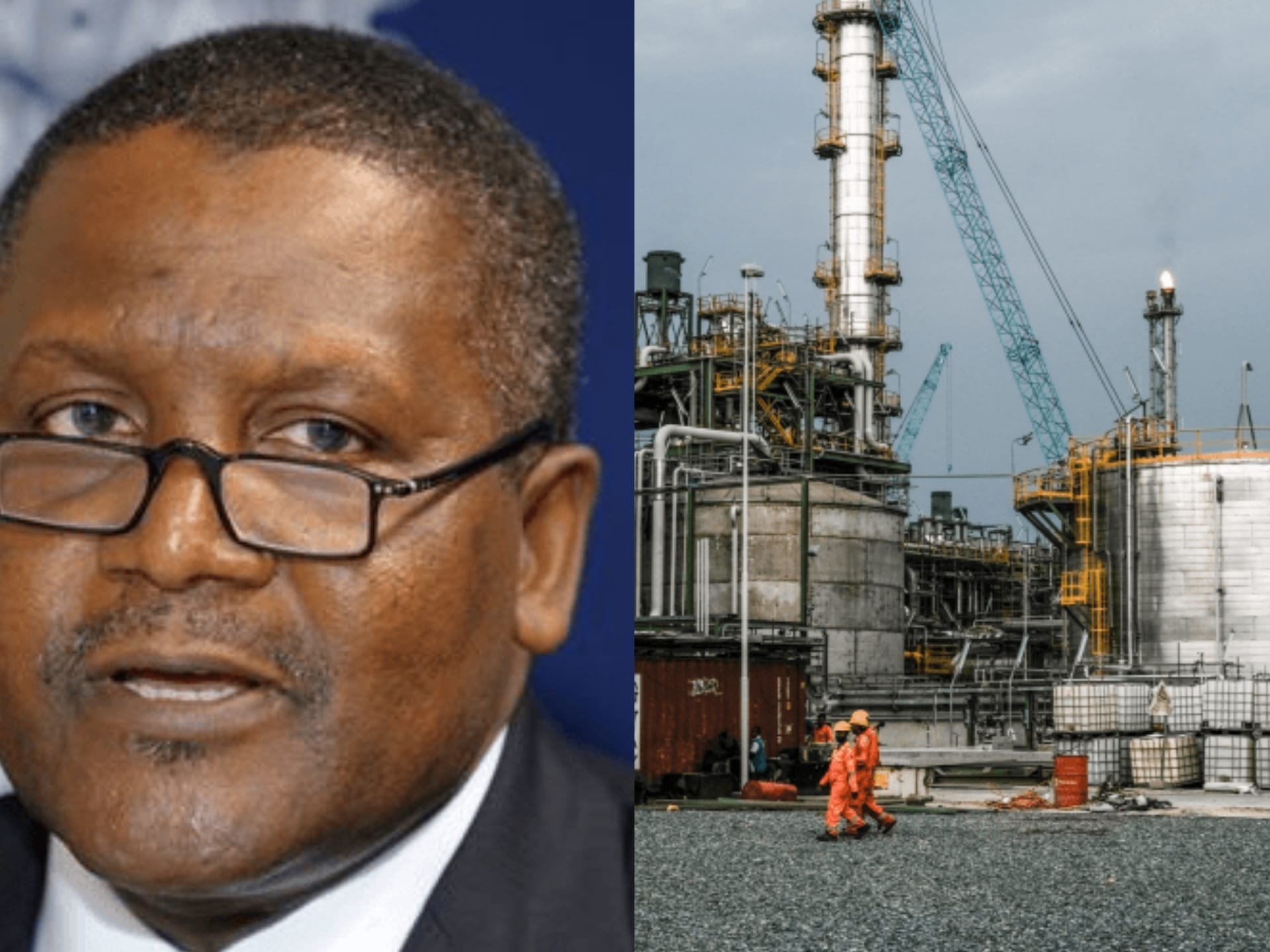

Aliko Dangote, Africa’s richest man, plans to sell up to 10 percent of Dangote Petroleum Refinery’s shares on the Nigerian Exchange (NGX) within the next year, according to Vanguard Nigeria. The move is aimed at reducing Dangote Group’s ownership to between 65 and 70 percent, following a strategy previously adopted by other Dangote subsidiaries such as Dangote Cement and Dangote Sugar Refinery.

The refinery, located in the Lekki Free Zone, Lagos, began operations in 2024 with a capacity of 650,000 barrels per day (bpd), and according to company plans, production is expected to increase to 700,000 bpd by the end of the year. Figures from Vanguard Nigeria indicate that the long-term goal is to reach 1.4 million bpd, surpassing the current largest refinery in Jamnagar, India. The company is also exploring strategic partnerships with Middle Eastern investors to fund the refinery’s expansion and a new petrochemicals project in China, as stated by company representatives.

Additionally, discussions are ongoing regarding a potential increase in the Nigerian National Petroleum Company’s (NNPC) stake in the refinery, which currently stands at 7.2 percent after a reduction from an initial 20 percent, according to sources familiar with the matter. The planned listing on NGX is expected to enhance market liquidity, attract new investors, and support the refinery’s ambitious growth objectives, according to analysts tracking Nigeria’s oil sector.